BREAKING SATIRE

August 17, 2007

Traders Turn to Black Humour

In one of the most turbulent weeks in the financial markets this year, there have been not only tears but also laughter as black humour have helped some of the world’s biggest banks and institutions come to terms with the prospect of huge losses.

As the FTSE 100 shed 4.1 per cent on Thursday – the biggest daily loss in more than four years – traders let rip with expletives and gallows humour in equal proportions as they grappled with the unprecedented volatility.

One joke likened the crisis in subprime assets – responsible for triggering the implosion of some hedge funds as they totted up billions of dollars in losses – to the Titanic disaster: as with the Titanic, the downside was not immediately apparent and only a few wealthy people got out in time.

One leading credit strategist said: “If you’re a trader who has lost a lot of money, there is a temptation to give up and turn to jokes. I would agree that, in the money markets in particular where credit lines have just dried up, there has been a real sense of panic. This week has been a bad one.”

Gary Jenkins, a portfolio manager at Synapse Investment Management, a hedge fund, said: “Some people may have turned to jokes to keep their spirits up but others are really crying.

The Financial Times

August 14, 2007

Hedge-Fund Guy Atones for His Subprime Bond Sins

By Mark Gilbert

Dear investor, we'd like to take this opportunity to update you on the recent performance of our hedge fund, Short-Term Capital Mismanagement LLP.

As you know, market selection for the entire fund is guided by a proprietary investing tool we like to call ``a dartboard.'' Once the asset classes are decided, individual security selections are generated by digitizing our unique hexagonal cuboid models.

You will appreciate that accurate pricing is essential for evaluating our investment strategies. This has proven to be extremely challenging in recent days. Previously, we have relied on Bob, the sales guy at Hokey-Cokey Bank. Bob assured us the securities were still worth 100 percent of face value, so everything was cool. Bob sold the collateralized debt obligations to us in the first place, so he knows what he's talking about.

Bob, however, appears to have had a nervous breakdown, judging by the maniacal laughter that greeted our requests for price verification this week.

Currently, all of the portfolios we manage are undergoing a rigorous screening known as ``crossing our fingers and praying that we don't have to try and find a bid in the market.'' This is supplemented by a cross-market statistical analysis originally developed by the U.S. military called ``don't ask, don't tell.'' This ``unmarking-to-unmarket'' procedure has been the benchmark for the hedge-fund industry for the past, ooh, 72 hours.

Some of you have written to us asking for your money back, citing clauses in the fund documentation called redemption rights. Frankly, we never expected you to actually read that prospectus. Do you have any idea how much trouble you all would be in if we actually sold this stuff in the market today? At these crazy prices? Fuhgeddaboudit. You'll thank us later.

Bloomberg |

| August 2007 |

| S |

M |

T |

W |

T |

F |

S |

|

|

|

|

1

|

2

|

3

|

4

|

|

5

|

6

|

7

|

8

|

9

|

10

|

11

|

|

12

|

13

|

14

|

15

|

16

|

17

|

18

|

|

19

|

20

|

21

|

22

|

23

|

24

|

25

|

|

26

|

27

|

28

|

29

|

30

|

31

|

|

|

|

|

|

« Previous |

Main Page

| Next »

|

Wall Street Laughs Up a Storm

By: Pete Kendall, August 20, 2007 |

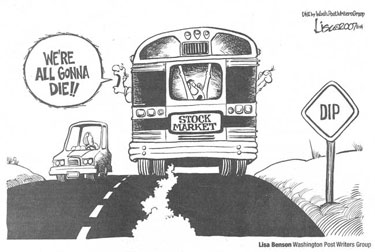

Another sign of a major mood change is the “gallows humor that prevails” around Wall Street. Last December, The Elliott Wave Financial Forecast predicted that a “desire for comic relief” would lead to a “whole new genre of social satire.”

The Elliott Wave Financial Forecast, June 2000 |

(from The Onion)

In July of 2000 when the first decline of the new millennium was still in its early stages, The Elliott Wave Financial Forecast showed a rendering of a man with suspenders and a brief case falling toward the earth saying, “The market’s been so volatile lately…by the time I hit the ground I might be a millionaire again!” “Cartoonists are cracking up readers with similar pieces at such a steady rate that the editor of a digest of cartoons has established a Wall Street section to which he posts five or six additions each day,” commented EWFF. As the images above and below illustrate, the same satiric impulse that occurred in the wake of the last big market peak is occurring now in the aftermath of the Dow Jones Industrial Average’s July 17 top.

Apparently the transition from financial euphoria to financial flight involves a certain blend of bemusement and derision. It happened in 2000 (see Additional References below for the relevant EWFF entries), and these caricatures of the subprime meltdown, stock volatility and hedge fund squeeze and the articles at left show it is happening now. In the early moments of a big bear market, people are still jolly enough to laugh off their losses. As the funk deepens, the playful cynicism will harden into harsher emotions that will be expressed in harsher ways.

|

|

|

Additional References

July 2000, EWFF

Another sign of a major mood change is the “gallows humor that prevails” around Wall Street and Silicon Valley. Last December, The Elliott Wave Financial Forecast predicted that a “desire for comic relief” would lead to a “whole new genre of social satire.” Cartoonists are cracking up readers with similar pieces at such a steady rate that the editor of a digest of cartoons has established a Wall Street section to which he posts five or six additions each day. A former TV writer has just published “The Trillionaire Next Door,” a twisted look at day trading. Newsweek says, “He has developed a weird new niche: satirizing the financial pages.” Modern Humorist, a producer of web-based parodies, has put out several wicked takes on the financial world, such as “The Fortune 5” issue of “Misfortune” magazine. “Depression, defeatism, despair… ‘Bring It On!’”

March 2000, EWFF

The December issue of EWFF predicted the emergence of “a whole new genre of social satire,” which is also appearing now in different forms. Business Week’s latest bull-market book list includes How to Get Filthy, Stinking Rich and Still Have Time for Great Sex. Another humorous takeoff, The Trillionaire Next Door: The Greedy Investor’s Guide to Day Trading, is classified as a “funny little book savaging the nation’s obsession with making easy money in the market.”

December 1999, EWFF

At this point, the mania is downright funny. The following take-off is excerpted from the Onion, an Internet lampoon:

Species of Algae Announces IPO

LAKE ERIE--Seeking to capitalize on the recent IPO rage on Wall Street, Lake Erie-based blue-green algae Anabaena announced Tuesday that it will go public next week with its first-ever stock offering.

Anabaena, a photosynthesizing, nitrogen-fixing algae with 1999 revenues estimated at $0 billion, will offer 200 million shares on the NASDAQ exchange next Wednesday under the stock symbol ALG. The shares are expected to open in the $47-$49 range.

“For every company that has a successful IPO, there are 10 others that flop,” said Brian Baum, head of online consulting for Ernst & Young. “But blue-green algae has a history of steady nitrogen production, as well as a very strong relationship with fungi, an environmental power player with whom it produces many common lichens. And with the number of living organisms on the planet rising every day, the demand for Anabaena’s many products and by-products should only grow.”

Some of the real deals we have seen are almost as laughable. The desire for comic relief will expand rapidly in the weeks ahead, so this piece probably marks the start of a whole new genre of social satire. |

|

Post a comment

|

|

|

|

| RECENT ARTICLES |

|

August 27, 2007

How Big is Peak? Skyscraper Index Soars Past Mt. Fuji

read more |

August 23, 2007

Bear Markets Go Better With Crackdown On Energy Drinks

read more |

August 21, 2007

Wake Up and Smell The $15 Cup of Coffee; This Is Not a Major Low

read more |

August 20, 2007

Wall Street Laughs Up a Storm

read more |

August 17, 2007

Now Is the Time to Brush Up on the Bank Run Basics

read more |

|

|

| ARTICLE COMMENTS |

|

|

|

|

|